- Link to Home page

- Link to Portfolio

Our portfolio

A flexible and comprehensive offering.

With our singular focus on hospitality, our platform is transforming the sector through bespoke investment, innovative asset management and ESG best practice.

Segment #1

Luxury

Boasting the highest level of service and amenities our luxury hotels offer opulent accommodations, fine dining and exclusive facilities. The emphasis is on creating an exceptional and indulgent experience for guests. These hotels cater to those seeking the utmost in comfort, elegance, and exclusivity.

South Africa

Cape Grace, A Fairmont Managed Hotel

- BROWNFIELD: 113 Keys

- SOUTH AFRICA: Cape Town

- ACQUISITION DATE: March 2022

Investment thesis

- Full-scale renovation to rebrand and reposition the hotel as a leading luxury hotel in Sub Saharan Africa

- Refurbished rooms and increasing suites in line with Fairmont brand standards

- Refurbished public areas, including adding a signature fine dining restaurant

- Established a new brand identity to distinguish Cape Grace from competitors while retaining its heritage

- Created an additional dining destination on a private quay in the V&A Waterfront

Amenities

2 F&B facilities | Whisky club | Wine cellar | Spa | Pool | Fitness center

Segment #2

Premium

Offering a higher level of service and more luxurious amenities, our Premium hotels provide guests with accessible luxury. These hotels often have stylish decor and a focus on providing a memorable experience.

Nigeria

Mövenpick Hotel Ikoyi Lagos

- BROWNFIELD: 170 Keys

- NIGERIA: Lagos

- ACQUISITION DATE: December 2020

Investment thesis

- Transition to the more widely recognized brand, Mövenpick

- Add revenue-generating components

- Soft refurbishment of rooms and redesign of public areas and F&B outlets - planned for 2026

- Events pavilion (~600 sqm) to capture lost business from competitors and non-hotel MICE offerings - planned for 2026

- Addition of Wojo space to complement the hotel offering, drive footfall into the complex, and capitalize on the prime office location - planned for 2026

Amenities

F&B | 600 sqm MICE | Gym | Pool | Wojo - post 2026 refurb

Ivory Coast

Pullman Abidjan

- BROWNFIELD: 265 Keys

- IVORY COAST: Abidjan

- ACQUISITION DATE: December 2020

Investment thesis

- Value creation strategy focused on revenue ramp-up and diversification

- Addition of Wojo diversifying hotel revenues and building resiliency

Amenities

1 Restaurant | 2 Bars | 7 Meeting rooms | Fitness & wellness center | Business center | Pool | Wojo

Senegal

Mövenpick Resort Lamantin Saly

- BROWNFIELD: 166 Keys

- SENEGAL: Saly

- ACQUISITION DATE: September 2022

Investment thesis

- Hotel rebrand to Mövenpick (December 2023), uplifting both ADR and hotel attractiveness

- Soft room refurbishment

- Increased existing premium offering by 20 keys

- Driving higher revenues and occupancy

- Maintenance deferred by previous owners now complete, along with hotel fire and safety aligned with international standards

- Adding new F&B outlets and conversion of underutilized space to MICE facilities

Amenities

3 F&B outlets | 4 Meeting & conference rooms | Fitness center | 2 Pools | 750 sqm Spa | Kids club

Senegal

Pullman Dakar

- BROWNFIELD: 247 Keys

- SENEGAL: Dakar

- ACQUISITION DATE: December 2020

Investment thesis

- Continue to push market-leading performance while improving cost structure

- Opportunity to acquire a high-performing asset in a location with limited further supply growth

- Achieved EDGE Advanced status

Amenities

1 Restaurant | 1 Bar | 4 Meeting rooms | Fitness & wellness center | Spa | Pool | Wojo

Kenya

Pullman Upper Hill

- BROWNFIELD: 206 Keys

- Pullman: 162 keys premium

- KENYA: Nairobi

- ACQUISITION DATE: August 2022

Investment thesis

- Capex program to reposition the hotel into dual-branded Pullman and Mercure (completion Q1 2024)

- Full public area and rooms renovation of the Pullman hotel (162 keys)

- Cost-effective upgrades to convert remaining 44 rooms to Mercure as a midscale offering

- Conversion of 2 vacant office floors to 1,000 sqm Wojo co-working space

- Potential additional F&B offering in the form of a Gastro Pub- remove this did not happen, to diversify on-property F&B experience and capitalize on corporate demand in the Upper Hill node

Amenities

Gym & Spa | 3 F&B facilities| 13 Meeting rooms |300-Person ballroom| Wojo

Rwanda

Mövenpick Kigali

- GREENFIELD: 124 Keys

- RWANDA: Kigali

- OPENED: November 2025

Investment thesis

- Acquired following Kasada’s engagements with Rwanda Development Board, aiming to restore the asset beyond its former status

- Complete gutting and refurbishment of the existing hotel into a modern Mövenpick, creating local employment and a unique, iconic destination

- Addition of MICE and coworking facilities to provide a full offering to guests

- Large plot size enables flexibility in facilities to appeal to guests seeking a green oasis in the city

Amenities

1 All Day Dining | 2 F&B outlets | 530 sqm MICE | 300 sqm Wojo

South Africa

Pullman Cape Town City Center

- BROWNFIELD: 124 Keys

- SOUTH AFRICA: Cape Town

- ACQUISITION DATE: August 2023

Investment thesis

- Investing in public areas to increase demand from leisure, executive corporate, and international FIT guests - Refurb of public areas planned for 2026

- Drive top-line performance by reconfiguring F&B offering to capture more guests - Refurb of F&B planned for 2026

- Rebranded to Pullman in September 2023

Amenities

3 F&B outlets | 7 Meeting rooms | 1 Pool | Fitness center

Namibia

Mövenpick Hotel Windhoek

- BROWNFIELD: 215 Keys

- NAMIBIA: Windhoek

- ACQUISITION DATE: July 2021

Investment thesis

- Conference center: c.3,900 sqm (2,400 pax), largest in the country

- Premium component rebranded as Mövenpick, focusing on F&B facilities to compete with existing premium hotels and create a destination for upscale dining and events

- Mövenpick brand resonates well with key European leisure source markets (Germany, The Netherlands, United Kingdom)

Amenities

1 Restaurant | 1 Bar | 3 Meeting rooms

Segment #3

Midscale & Economy

Offering a balance between affordability and comfort. They provide more amenities than economy hotels, such as on-site dining, fitness centres, and business facilities. The rooms are more spacious and may include additional features like mini-fridges and coffee makers. These hotels are ideal for travellers seeking a comfortable stay without breaking the bank.

Ivory Coast

Novotel Abidjan

- BROWNFIELD: 258 Keys

- IVORY COAST: Abidjan

- ACQUISITION DATE: December 2020

Investment thesis

- Established hotel with opportunity to expand MICE and optimize back office

Amenities

1 Restaurant | 1 Bar | 8 Meeting rooms | Fitness center | Business center | Pool

Cameroon

Ibis Douala

- BROWNFIELD: 160 Keys

- CAMEROON: Douala

- EXITED IN: July 2024

Investment thesis

- Value creation strategy focused on revenue ramp-up and diversification

- Addition of Wojo to diversify hotel revenues and build resiliency

- Sold hotel in July 2024 as part of active portfolio management strategy; the hotel was not a long-term strategic asset for Kasada

Amenities

1 Restaurant | 2 Bars | 7 Meeting rooms | Fitness & wellness center | Business center | Pool

Ivory Coast

Ibis Styles Abidjan Plateau

Brownfield (190 keys)

- BROWNFIELD: 190 Keys

- IVORY COAST: Abidjan

- ACQUISITION DATE: December 2020

Investment thesis

- Re-positioned as a quality economy asset through renovation and re-branding to ibis Styles (fully reopened September 2023)

- Addition of well-adapted and localized F&B concept increasing walk-in guest revenues

Amenities

1 Restaurant | 1 Bar | 3 Meeting rooms | Wojo

Ivory Coast

ibis Styles Abidjan Marcory

- BROWNFIELD: 135 Keys

- IVORY COAST: Abidjan

- ACQUISITION DATE: December 2020

Investment thesis

- Re-positioned as a quality economy asset through renovation and re-branding to ibis Styles (fully reopened September 2023)

- Addition of well-adapted and localized F&B concept increasing walk-in guest revenues

- Increasing walk-in guest revenues

- Introduced Wojo to capitalize on strong demand and drive foot traffic, which benefit other revenue drivers

Amenities

1 Restaurant | 1 Bar | Meeting rooms | Pool | Wojo

Senegal

Novotel Dakar

- BROWNFIELD: 241 Keys

- SENEGAL: Dakar

- ACQUISITION DATE: December 2020

Investment thesis

- Refurbishing public areas to enhance leading midscale positioning with new revenue generating areas

- Expanding facilities (MICE, Wojo, and gym) and improving the F&B concept

- Improving guest circulation within the ibis and Novotel combo to retain guests longer and increase average spend

- Reintroducing 20 rooms (2024–2025) previously used as offices to increase hotel capacity and capitalize on strong demand

Amenities

1 Restaurant | 1 Bar | 10 Meeting rooms | Pool | Wojo

Ivory Coast

ibis & Adagio

Greenfield project (170 keys)

- GREENFIELD: 170 Keys

- IVORY COAST: Abidjan

- SCHEDULED OPENING: 2026

Investment thesis

- Located in a fastest growing middle-class area in Abidjan, within an attractive mixed-use precinct with a shopping mall, being developed by HC Capital Partners

- Local area lacks any branded supply (with no pipeline), enabling capitalization on first mover advantage in an area with growing demand as well as significant cross-selling opportunities with the adjacent mall

Amenities

Hotel will include F&B and MICE facilities | Wojo

Senegal

ibis Styles

- BROWNFIELD: 106 Keys

- SENEGAL: Dakar

- ACQUISITION DATE: December 2020

Investment thesis

- Shared facilities, such as the pool, available at Novotel Dakar (same property)

- Refurbishment and rebrand to ibis Styles to better cater to market demands and maintain historical performance

- Improve guest circulation between the ibis and Novotel combo to retain guests longer and increase average spend

- Hotel performing ahead of expectations, supported by strong occupancy

Amenities

1 Bar | 2 Meeting rooms

Namibia

Mercure Hotel Windhoek

- BROWNFIELD: 199 Keys

- NAMIBIA: Windhoek

- ACQUISITION DATE: July 2021

Investment thesis

- Completed in June 2023

- Attracting significant government and corporate demand

- Opportunity to become a premier leisure & MICE destination

- Lower-midscale component rebranded as Mercure, filling the market gap for a branded midscale hotel in Windhoek

- Market convention center positioned as the premier events location in SADC

- Creating a “restaurant village” concept and family entertainment area, providing a non existent family entertainment & leisure offering in Windhoek

Amenities

14 Meeting rooms | Fitness center | 3 F&B outlets | Spa | Pool

Kenya

Mercure Nairobi Upper Hill

- BROWNFIELD: 206 Keys

- Mercure: 44 keys midscale

- KENYA: Nairobi

- ACQUISITION DATE: August 2022

Investment thesis

- Capex program to reposition the hotel into dual-branded Pullman and Mercure (completion Q1 2024)

- Full public area and rooms renovation of the Pullman hotel (162 keys)

- Cost-effective upgrades to convert remaining 44 rooms to Mercure as a midscale offering

- Conversion of 2 vacant office floors to 1,000 sqm Wojo co-working space

- Potential additional F&B offering in the form of a Gastro Pub- remove this did not happen, to diversify on-property F&B experience and capitalize on corporate demand in the Upper Hill node

Amenities

Gym & Spa | 3 F&B facilities | 13 Meeting rooms | 300-Person ballroom | Wojo

Segment #4

Lifestyle

Providing basic accommodations at an affordable price. They typically offer essential amenities such as clean rooms, free Wi-Fi, and breakfast options. The focus is on functionality and value for money, catering to budget-conscious travellers.

South Africa

Mama Shelter Cape Town

- GREENFIELD: 177 Keys - Hotel 123, 54 Apartments

- SOUTH AFRICA: Cape Town

- SCHEDULED OPENING: 2026

Investment thesis

- Significant additional lifestyle elements in the redevelopment program, including Ennismore F&B concepts, to further enhance the hotel and attract existing heavy footfall in the area

- Ground floor and 9th floor F&B, alongside co-working areas, to create a positive cycle from guests using the building’s amenities

- Mama Shelter residences targeted to be sold at attractive premiums, helping de-risk part of the investment

Amenities

4 F&B outlets | 1 Pool | Fitness center | Conference rooms | Wojo

South Africa

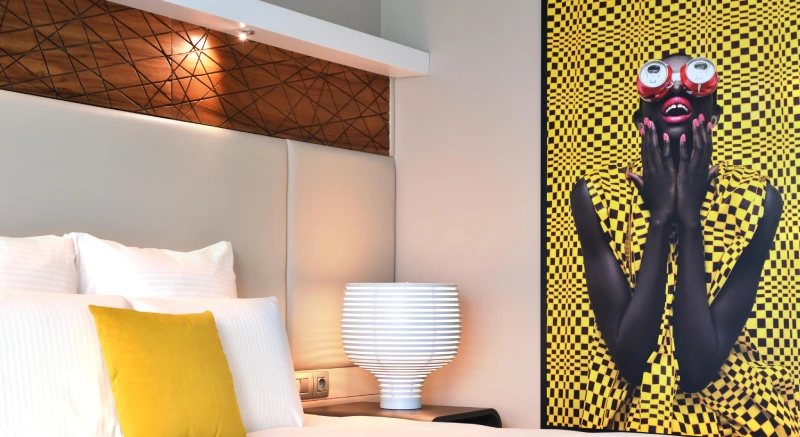

Hyde Johannesburg

- BROWNFIELD: 131 Keys

- SOUTH AFRICA: Johannesburg

- ACQUISITION DATE: September 2024

Investment thesis

- Award-winning lifestyle hotel in one of the most vibrant areas of Johannesburg

- Seamless integration of best-in-class hotel, restaurant, co-working, and commercial spaces

Amenities

1 Restaurant | 1 Bars | 1 Coffee shop | Gym | Co-working

South Africa

Mama Shelter Cape Town

- GREENFIELD: 177 Keys - Hotel 123, 54 Apartments

- SOUTH AFRICA: Cape Town

- SCHEDULED OPENING: 2026

Investment thesis

- Significant additional lifestyle elements in the redevelopment program, including Ennismore F&B concepts, to further enhance the hotel and attract existing heavy footfall in the area

- Ground floor and 9th floor F&B, alongside co-working areas, to create a positive cycle from guests using the building’s amenities

- Mama Shelter residences targeted to be sold at attractive premiums, helping de-risk part of the investment

Amenities

4 F&B outlets | 1 Pool | Fitness center | Conference rooms | Wojo

South Africa

Hyde Johannesburg

- BROWNFIELD: 131 Keys

- SOUTH AFRICA: Johannesburg

- ACQUISITION DATE: September 2024

Investment thesis

- Award-winning lifestyle hotel in one of the most vibrant areas of Johannesburg

- Seamless integration of best-in-class hotel, restaurant, co-working, and commercial spaces

Amenities

1 Restaurant | 1 Bars | 1 Coffee shop | Gym | Co-working

Lifestyle portfolio: ibis Styles Abidjan Plateau

Our impact

Committed to delivering long-term positive and sustainable impact and value to all stakeholders.

Our strategy

Identifying opportunities that add value and meet the structural demands of the African market.